Property Tax Rate Louisiana . louisiana property tax millage rates by parish. Louisiana is rank 43rd out of. Louisiana does not have an estate. in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). In louisiana, the assessment level is set at 10% for. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. louisiana uses the following method to calculate your real property tax rate, according to the louisiana tax. Our goals are to provide.

from taxfoundation.org

Louisiana does not have an estate. louisiana property tax millage rates by parish. in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). Louisiana is rank 43rd out of. louisiana uses the following method to calculate your real property tax rate, according to the louisiana tax. Our goals are to provide. In louisiana, the assessment level is set at 10% for. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median.

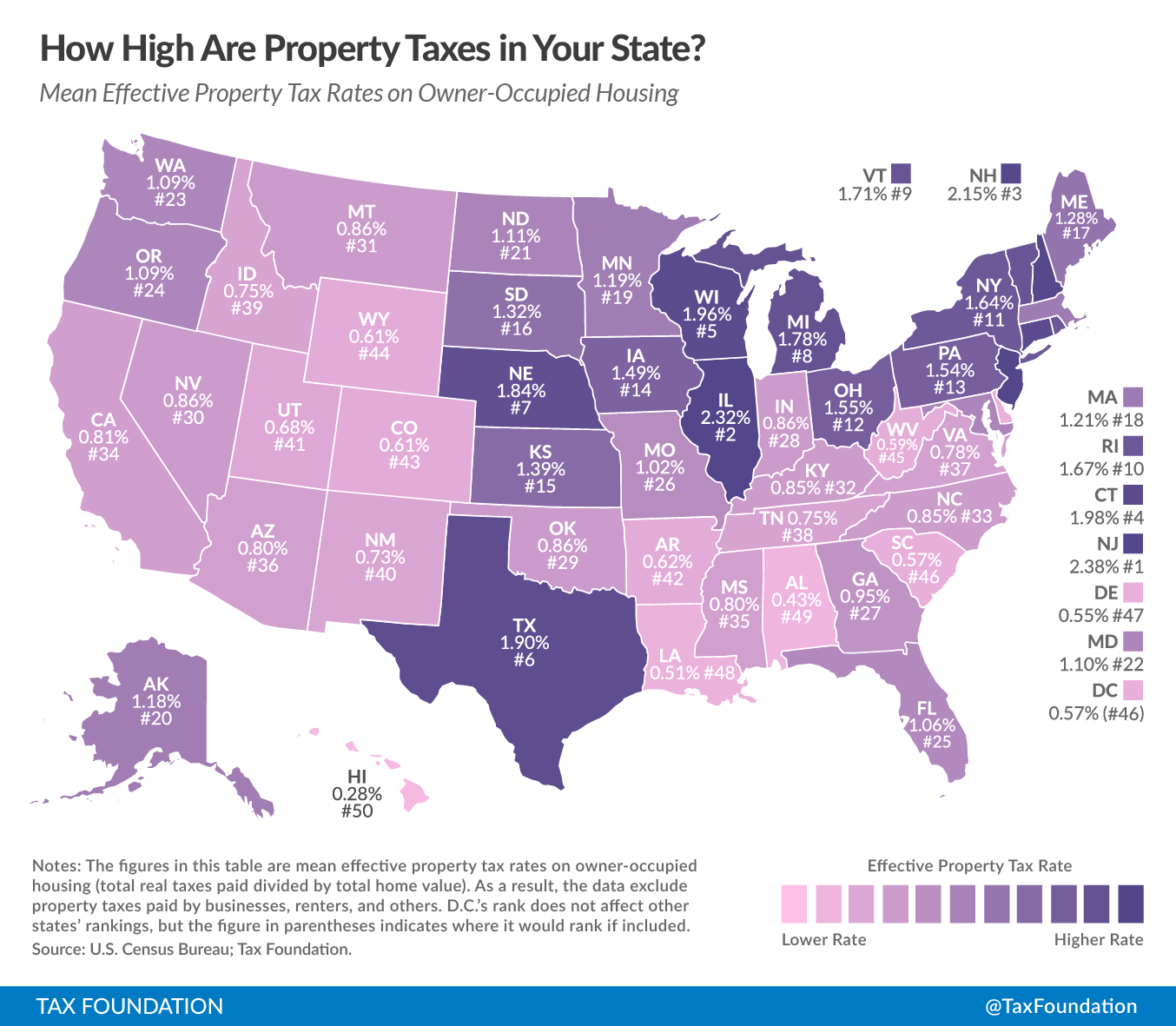

How High Are Property Taxes in Your State? Tax Foundation

Property Tax Rate Louisiana In louisiana, the assessment level is set at 10% for. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. Louisiana does not have an estate. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. louisiana property tax millage rates by parish. louisiana uses the following method to calculate your real property tax rate, according to the louisiana tax. Our goals are to provide. In louisiana, the assessment level is set at 10% for. Louisiana is rank 43rd out of.

From taxfoundation.org

To What Extent Does Your State Rely on Property Taxes? Tax Foundation Property Tax Rate Louisiana louisiana uses the following method to calculate your real property tax rate, according to the louisiana tax. louisiana property tax millage rates by parish. Louisiana does not have an estate. Our goals are to provide. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. louisiana (0.55%) has a 46.1%. Property Tax Rate Louisiana.

From eyeonhousing.org

Property Taxes by State 2016 Property Tax Rate Louisiana louisiana property tax millage rates by parish. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. Our goals are to provide. louisiana uses the following method to calculate your real property tax rate, according to the louisiana tax. Louisiana is rank 43rd out of. the median property tax in. Property Tax Rate Louisiana.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate Louisiana In louisiana, the assessment level is set at 10% for. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. Louisiana is rank 43rd out of. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). louisiana property tax millage rates by parish. Louisiana does. Property Tax Rate Louisiana.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Property Tax Rate Louisiana louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. In louisiana, the assessment level is set at 10% for. louisiana property tax millage rates by parish. Our goals are. Property Tax Rate Louisiana.

From www.mortgagecalculator.org

Median United States Property Taxes Statistics by State States With Property Tax Rate Louisiana louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. Louisiana is rank 43rd out of. Louisiana does not have an estate. louisiana property tax millage rates by parish. in louisiana, property tax amounts. Property Tax Rate Louisiana.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Property Tax Rate Louisiana Louisiana does not have an estate. In louisiana, the assessment level is set at 10% for. Our goals are to provide. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. louisiana property tax millage rates by parish. our mission is to serve louisiana taxpayers fairly. Property Tax Rate Louisiana.

From taxwalls.blogspot.com

How Much Are Property Taxes In Louisiana Tax Walls Property Tax Rate Louisiana Our goals are to provide. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). In louisiana, the assessment level is set at 10% for. in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. our mission is to. Property Tax Rate Louisiana.

From finance.georgetown.org

Property Taxes Finance Department Property Tax Rate Louisiana louisiana property tax millage rates by parish. louisiana uses the following method to calculate your real property tax rate, according to the louisiana tax. in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. our mission is to serve louisiana taxpayers fairly and with. Property Tax Rate Louisiana.

From taxfoundation.org

Ranking State and Local Sales Taxes Property Tax Rate Louisiana in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. Louisiana does not have an estate. Louisiana is rank 43rd out of. louisiana property tax millage rates by parish. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws.. Property Tax Rate Louisiana.

From www.housingwire.com

Property taxes on singlefamily homes increase 6 in 2017 HousingWire Property Tax Rate Louisiana in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. Our goals are to provide. Louisiana is rank 43rd out of. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). louisiana property tax millage rates by parish. Louisiana. Property Tax Rate Louisiana.

From www.marketwatch.com

Want to see how America is changing? Property taxes hold the answer Property Tax Rate Louisiana In louisiana, the assessment level is set at 10% for. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). louisiana uses the following method to calculate your real property tax rate, according to the louisiana tax. Louisiana does not have an estate. Louisiana is rank 43rd out of. the median. Property Tax Rate Louisiana.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Property Tax Rate Louisiana louisiana property tax millage rates by parish. Louisiana is rank 43rd out of. In louisiana, the assessment level is set at 10% for. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. Our goals are to provide. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of. Property Tax Rate Louisiana.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Property Tax Rate Louisiana In louisiana, the assessment level is set at 10% for. in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. Our goals are to provide. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). louisiana uses the following. Property Tax Rate Louisiana.

From www.expressnews.com

Map Keep current on Bexar County property tax rate increases Property Tax Rate Louisiana the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. In louisiana, the assessment level is set at 10% for. Louisiana does not have an estate. louisiana property tax millage rates by parish. in louisiana, property tax amounts are determined by multiplying the tax rate (or. Property Tax Rate Louisiana.

From www.ezhomesearch.com

Your Guide to Louisiana Property Taxes Property Tax Rate Louisiana Our goals are to provide. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. Louisiana does not have an estate. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. In louisiana, the assessment level is set at 10% for.. Property Tax Rate Louisiana.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rate Louisiana In louisiana, the assessment level is set at 10% for. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. louisiana property tax millage rates by parish. our mission is to serve louisiana taxpayers fairly and with integrity by administering property tax laws. in louisiana,. Property Tax Rate Louisiana.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Rate Louisiana louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. In louisiana, the assessment level is set at 10% for. the median property tax in louisiana is $243.00 per. Property Tax Rate Louisiana.

From www.pinterest.com

Chart 4 Louisiana Local Tax Burden by County FY 2016.JPG Burden Property Tax Rate Louisiana in louisiana, property tax amounts are determined by multiplying the tax rate (or millage rate) by the assessed value of the property. louisiana (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). Louisiana does not have an estate. the median property tax in louisiana is $243.00 per year, based on a. Property Tax Rate Louisiana.